Staying Fit

Q: I took my 2020 required minimum distribution (RMD) back in January before the law changed, allowing 2020 RMDs to be waived. Can I return those funds and eliminate the tax?

—J.W.

Yes, you can! But you must do it before Aug. 31.

The answer was a different one when this question was asked earlier in the year, but the IRS has released new relief provisions for unwanted RMDs (IRS Notice 2020-51, issued June 23).

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

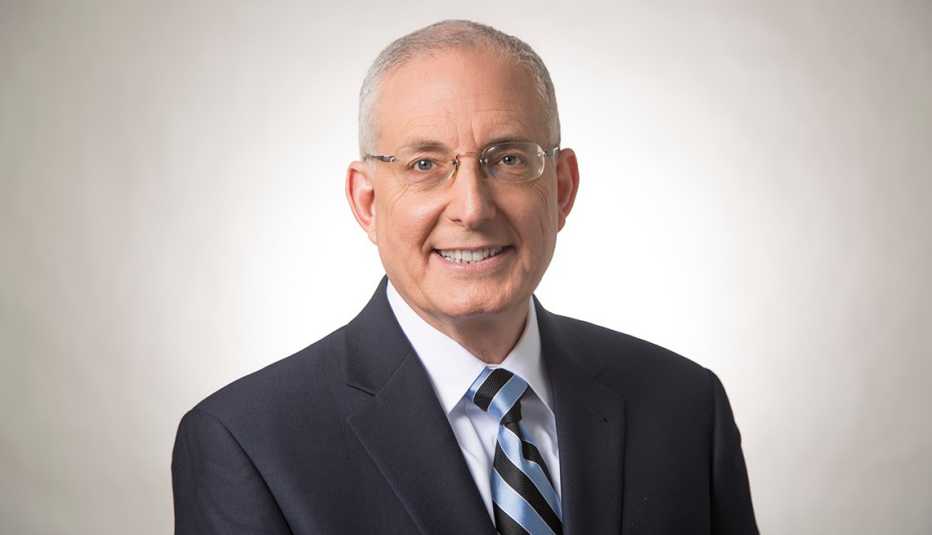

Ask Ed Slott

Confused about IRAs, 401(k)s, Roths, taxes and more related to saving for retirement? Ed has the answers. Email your questions to IRAHelp@aarp.org.

The CARES Act waived RMDs due in 2020, but that law was not enacted until March 27, and by that time some folks had already taken their RMDs and would have owed the tax on those withdrawals. Once the law waived 2020 RMDs, some of these people cried foul, since they had already taken the funds.

Back in April, the IRS provided limited relief and allowed some people to return the unwanted RMD funds — that is, roll them back to an IRA or 401(k) to wipe out the tax bill. Unfortunately, that relief didn't cover anyone who took the RMD in January.

The earlier relief also was of no help for those who had already done an IRA-to-IRA rollover within the past 12 months, because of the once-per-year IRA rollover rule. Under that rule, you can do only one IRA-to-IRA or Roth IRA-to-Roth IRA rollover every 365 days. For example, if you took monthly RMD withdrawals (as many do), in January, February and March, you could return only one withdrawal. For any others, you were out of luck, due to this once-per-year IRA rollover rule.

In addition, the April guidance gave a July 15 deadline to return the unwanted RMD funds. Now that we are running up against that deadline, the IRS responded to many of these issues with unprecedented blanket relief. And it should get a big pat on the back for that: The agency is working under reduced staffing conditions and has many other COVID-19-related relief provisions to deal with.

So, here's the good news: Anyone who took an RMD in 2020 can return those funds, if they do it by Aug. 31, no questions asked — like when you return items to the store!